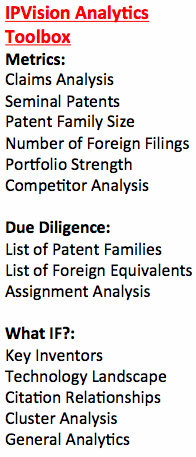

To this point, we have discussed the importance of IP and the high level questions a Board of Directors should ask Management about the company’s intellectual property. These questions cover a wide range, believe it or not. It’s never so simple as simply knowing which patents the company holds, though many Boards leave even that much to the IP lawyers. First, there’s the deep dive into research and development, which questions such as: