The forecasted development of intellectual property and patents as an asset class has arrived in the high technology sector. Increasingly, patent due diligence is now at the front end of M&A transactions. On Tuesday, March 6, IPVision's Dr. Hoo-min Toong will join leading corporate IP counsel and seasoned professionals from Apple, Cisco, Google, Kodak, Intel, JDSU, Nortel and Yahoo, to discuss this trend in San Francisco at the PLI Seminar "IP-Driven M&A: The Revolution Has Arrived."

On Tuesday, March 6, IPVision's Dr. Hoo-min Toong will join leading corporate IP counsel and seasoned professionals from Apple, Cisco, Google, Kodak, Intel, JDSU, Nortel and Yahoo, to discuss this trend in San Francisco at the PLI Seminar "IP-Driven M&A: The Revolution Has Arrived."

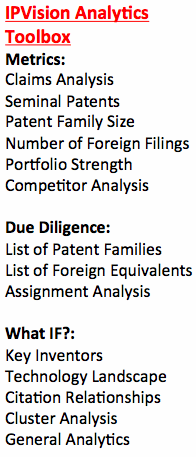

The core message of the session, as explained by Dr. Toong, is "don't waste time and money - use analytics and automation to gather the information needed." Panelists concurred that by "doing the basic analysis up front, you can remove much of the chaff and noise, so that expert (expensive) time can be spent on what matters most..."

From the broader program, key themes of to be discussed include:

-

The historical evolution of IP-driven M&A

-

The factors responsible for the recent shift in IP-driven M&A

-

The importance of market context

-

How traditional investment bankers look at IP-centric deals

-

The challenges of estimating risk-adjusted patent value

-

Best practices in diligence quality and the impact of large patent portfolios

-

What lays ahead: IP gold rush or patent bubble?

In respect to patent due diligence, key leaders from JDS Uniphase and Google will join IPVision's Dr. Toong to share insights and best practices, including

-

How to assess patent quality and risk: the use (and misuse) of software-based analytics.

-

Best practices in evaluating patent quality, impact and value?

-

How does a prospective patent buyer efficiently diligence a very large portfolio (i.e., thousand of patents)?

-

What should prospective buyers look for in an analytics platform?

-

How should buyers integrate automated and human patent analysis?

Specific examples to be reviewed during the panel include patent holdings of Motorola Mobility, Microsoft, Nortel (now owned by the Rockstar Bidco consortium), RIM and Apple.

Additional information on these examples and best practices is available upon request. These example documents and earlier IPVision blog articles on M&A, patent portfolio assessment and patent due diligence provide initial insights - let IPVision know if additional specific information or insights would be useful.