The first article in this series discussed the reasons for increased activity in Patent Portfolio Trafficking, i.e. patent portfolios offered for sale or license. The second article described how companies with Small Volumes of portfolios to evaluate were able to streamline their patent evaluation processes from weeks to days using a Metric Driven Approach. The third article looked at companies that have more fully Integrated Patent Analytics into their patent portfolio acquisition process. This article discusses how organizations dealing with larger volumes of patents are integrating IPVision’s efficient and comprehensive patent evaluation metrics into their processes.

Prototypical Situation

There are two categories of “larger patent volume” organizations: (1) Large Operating Companies (“Large Enterprises”) and (2) Non-Practicing Entities (“NPEs”). These organizations are on the opposite sides of potential patent acquisition or patent sale or patent licensing transactions. A NPE is seeking to evaluate patents for acquisition to be used by its “members” or to be used against others and as such seeks to bring business related metrics into the patent evaluation or patent valuation process. The Large Enterprises are on the receiving side of broker or NPE offerings. For this article we will focus on Large Enterprises.

The Large Enterprise that is deploying comprehensive patent evaluation metrics and processes is doing so because it is a very visible company and typically has a large volume of “in-bound” offering activity – e.g., ranging from 2 per month (24 per year) to 1 to 2 per week (50 to 100 per year). It has an established patent group that includes patent lawyers and patent licensing experts as well as business executives overseeing the IP Strategy from a business perspective. The size of the patent group ranges from 20 to over 100 people who have a high level of sophistication within their relevant expertise domains. Its own patent portfolio usually numbers in the thousands to tens of thousands patents and it has a worldwide perspective. Depending on its business unit structure it may have a single centralized Patent Review Committee, or multiple Patent Review Committees in the individual business units or a hybrid of business unit committees with liaison to an overall corporate Patent Committee.

The Large Enterprise has made efforts to refine and adapt its patent processes to work more effectively within its overall business structure and culture. Because it is a large organization it has a significant budget and often has subscribed to multiple patent software tools.

Attributes of the Large Enterprise Patent Process

- Significant Number of Patents = Large Historical Investment

- Sophisticated Personnel

- Access to Patent Software Tools

- Relatively High Visibility to Senior Management

- Increased Patent to Business Context

- Varying Degrees of Evaluation Metrics

- Problems:

- Large Volume of Portfolios to Evaluate

- Time and Resource Consuming – Inefficient Manual Review

- Repeatability of Analysis is Uncertain

- Limited Scalability

IPVision Involvement

We have worked with a number of Large Enterprises to implement efficient, comprehensive and timely patent portfolio evaluation processes. A sample case is a company (“LargeCo”) that had a backlog of several hundred patent portfolios to review. It was taking well over 3 months of elapsed calendar time for the business analysts, technical personnel and lawyers to review each portfolio, and that was for the portfolios that they actually got to. It was estimated the backlog would take 6 to 9 months to clear if no new portfolios were offered. However, the volume of new offerings was in the range of 5 to 10 per week on average. LargeCo realized that it was missing opportunities to find good patents as deals went cold over time.

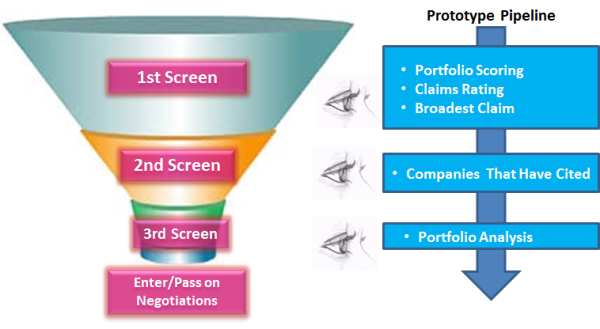

We initially proposed that LargeCo use a “pipeline” approach involving 3 screens each of which used standard IPVision Patent Analytics. For Screen 1 reviewers would receive Patent Portfolio Quality Metrics: Level 1 Portfolio Rating Report (described in the second article of this series), Claims Rating, and Broadest Claim Analysis. If the portfolio passed the quality threshold we would present Screen 2: an initial business metric involving an analysis of Companies Citing the Portfolio. Screen 3 was an in depth Patent Portfolio Analysis.

LargeCo decided that separate manual review of each Screen would interrupt workflow so IPVision integrated all Screens into a single step. We also provided standard IPVision patent analytics at the individual patent level, including claims ratings, relative citation frequency analytics and patent family analysis to determine if all related properties were included in the offered portfolio. We applied IPVision formulae to the various Patent Attributes to identify the most important patents in a portfolio.

The resulting portfolio rating, individual patent analytics and formulae results were posted on the IPVision Advantage Analytics™ System. The patents that are identified as important by the formulae are highlighted and sorted for review.

Result: 10x Improvement

As a result of implementing IPVision's iScore™ analytics and process LargeCo was able to eliminate the backlog within 6 weeks. With the backlog removed, IPVision continues to process the 5 to 10 portfolios received each week. Turnaround is 2 to 3 business days. LargeCo reviewers are able to complete their review of these portfolios in a few days, resulting in a turnaround of less than one week. The net impact was a process that is 10 times more efficient requiring less than 1/10th the time required before IPVision involvement.

With the time saved in reviewing in-bound patent portfolio LargeCo is applying IPVision’s process to get ahead of the game by actively mining the patent landscape for companies with strategic patent assets that can support LargeCo’s strategic business plans.

About IPVision

IPVision was founded in 2000 by MIT Faculty who developed data analytics and data visualization technology to understand patents from a business perspective in support of commercializing new technologies. Since then IPVision has continued to be at the forefront of developing and applying patent analytics to support business decisions. We have worked with many Fortune 500 companies, venture capital and law firms, as well as startup and growth companies. Our analytics and processes have been used by merger and acquisition professionals, patent licensing experts, R&D executives, business strategists, patent transaction professionals, patent prosecution lawyers and patent litigators.

Author: Joseph G. Hadzima, Jr. | Senior Lecturer, MIT Sloan School of Management | Co-Founder & President of IPVision, Inc.