As cash continues to accumulate on corporate balance sheets, pressures are rising to increase returns. Given the correlation between high-quality IP holdings and successful exit from venture capital funds, learn how leading strategy practitioners, investors, and business development functions gain from including patent portfolio analytics in their tool-kit.

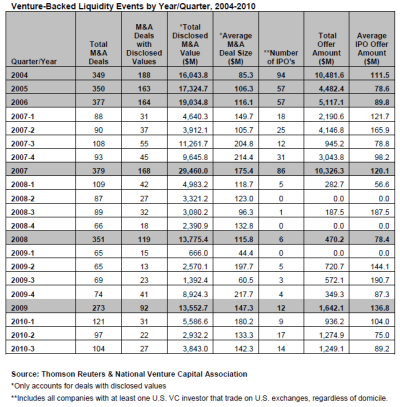

With increasing cash balances, and growth imperatives, it is not surprising that the M&A market continues to expand. Thomson Reuters and the National Venture Capital Association report that fund exits by acquisition in 2010 are at a level on par with 2006 and 2007 – when the economy was in a far different state.

Leading strategy practitioners and business development executives charged with corporate growth intuitively “know” that patent rights contribute immensely to the value received in an acquisition – however, they traditionally have not fared well in assessing the relative quality and position of those components of value. IPVision’s patent portfolio analytics, as discussed in a recent Intellectual Asset Management Magazine article, provide a consistent, evidence-based approach to obtain key insights into the relative strength and quality of a firm’s IP holdings – and of the management team’s investment in those rights.

We observe three best practices adopted by clients charged with these decisions:

- Investment analysis

- Acquisition pipeline analysis

- Acquisition due diligence and integration planning

In investment analysis VC funds (either traditional or corporate venture) and private equity are able to quickly obtain a consistent view of multiple potential investment candidates’ patent positions. These ratings and the underlying details available in reports and in the IPVision Advantage™ online platform, provide insights into the development of patent portfolios, insights into the company’s strategy and management caliber, and the relative position of the company amongst its direct competitors and potential acquirers seeking platforms for future growth.

Acquisition targeting and pipeline analysis provides corporations with a method to identify those firms that may add high value to their organization through partnership or acquisition. Whether developing core technology extensions or future platforms – assessing the broader landscape to identify desirable technology leaders, understand their financial backing and estimated burn rate provides critical insights to focus relationship building and corporate intelligence efforts. In this role, we see leading firms utilizing acquisition candidate dashboards that monitor and track changes to target companies IP assessments and watch for important developments – generally through quarterly updates.

Acquisition due diligence and integration planning builds upon portfolio assessments to help the combined firm understand how to build out a strategic patent position that embraces the combined elements of both legacy portfolios. Further, this planning process and analytics-driven insights can lead to patent monetization (or sale) and the reduction in patent maintenance expense by identifying non-core assets that might best be divested.

One additional tip: patent portfolio analytics and due diligence helps identify key inventors that the management and HR team should treat with care during the integration process to avoid losing valuable talent and intellectual capital to eager competitors and recruiters watching the combined company for potential new hires.