It happens all too often: A company hits big and then slowly fades into obscurity when they fail to produce follow-up products or develop a business plan that can introduce additional revenue streams.

Keurig is one such company. With their industry-disrupting coffee maker, they nudged aside Black & Decker and Cuisinart for a few years, as buyers clamored for something easy to use and, yes, a little gimmicky. Without a new product to introduce—at least not one that wasn’t simply an improvement upon the first iteration—Keurig has since watched their grasp on the market slowly slip away.

The same occurred with TiVo, the forerunner to DVR. With only the one service on offer, the company made a run for IPO. At its height, the stock was almost $58 per share, but before that same year ended, it dropped to just under $6. A company flatlined within the same year it went public, simply because someone else was able to do the same thing…but better. And TiVo had nothing else waiting in the wings.

FitBit on the Same Path

While no one would consider FitBit a flatline just yet, they’re in the running to flop as hard as TiVo did if they’re not careful. At the beginning of this year, FitBit reported a 20% drop in sales, and this after the holiday season. As a result, the company had to lay off 6% of the workforce. Soon after, shares fell below $6, a huge slide from the initial offer of $20.

At one point, they had an offer for purchase from Apple, but they decided to keep doing what they did—essentially remaining at commodity product level—and attempt to compete with the company that offered to make a purchase. Now they’re probably wishing for another acquisition offer as they await the release of a smartwatch that has none of the capabilities the Apple watch offers.

We may be about to watch this star flicker out.

A Dead Ring?

While currently considered a darling of the tech world, with $109 million as an initial investment, Ring is setting itself up for a long, hard road back to the bottom, we fear. Sure, they have big name investors like Goldman Sachs, Shea Ventures, Qualcomm Ventures, and the Virgin himself, Richard Branson. However, the huge raise in capital doesn’t hold a candle to the cash reserves of Google.

And Google is who Ring has to beat if they want to stay on top. Unfortunately, with nothing on offer by a wifi-connected doorbell and camera, they come up short in the smart home product offerings. After buying that first one, what else do they need that Ring can offer?

Worse, the Nest smart home system from Google also offers a doorbell and camera that connects to the whole system, as well as lighting, door locks, thermostat, garage door openers, and many other incredible features. When it comes to a choice of a fully integrated smart home system, Ring can’t hold a candle.

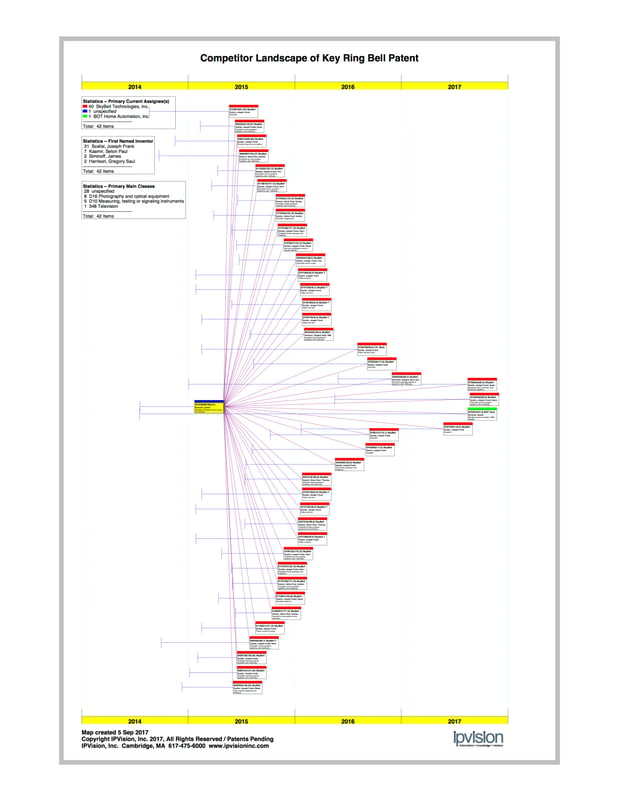

Finally, there’s the little matter of protected intellectual property…and the fact that Ring only holds a few patents that have already been boxed in by competitors. Even if they wanted to protect their innovation, they couldn’t. If they think they’ve taken the world by storm so they don’t need to worry about the giants like Google coming to get them, it’s time for them to think again.

Then There’s 23andMe

Currently working their way toward an IPO is 23andMe, the DNA and genetic testing product. They’re already a little behind the game, since genealogy giant Ancestry.com also offers a DNA testing service. However, they’ve managed to cultivate a big following and bring in millions in revenue with their ancestry service, which allows customers to connect with potential relatives who’ve also taken the DNA test. There’s also their health analysis kit, which uses DNA information to provide a health heads’ up for customers.

The problem is, how many people will ever buy a DNA test more than once? Unless they purchase a kit as a gift, they’ll only ever need the results once in their lives, and after that gift is given, the recipient won’t need to purchase, either.

Where is the future of a company with only one product? Especially considering that this one particular product is also offered by several other larger companies. The logical conclusion is that 23andMe will need another revenue stream, and quickly, or they’ll begin to decline immediately after IPO, just as previous “hot” companies have before.

Is There Hope?

Now, we’ve considered the reasons these companies are likely to be one-trick ponies, just as Keurig and TiVo before them. Is there hope? Of course there is. With an eye toward the intellectual property they already own—except in the case of Ring, but they could still approach the patent process before it’s too late—additional products could be developed.

It’s part and parcel of the IPVision method to consider IP before making any further decisions, both the intellectual property of the client and that of their competitors. Then we take a look at the company’s core competencies so as not to send them down a path that makes no sense for the company’s future—much like Apple’s terrible Pippin game console.

With direction for product development or IP acquisition, these companies could find a new trick in time to save the whole show. Perhaps time will tell. If you feel your company may be struggling to take the next big step in innovation, give us a call. We’d love to discuss your options.