The first article in this series discussed the reasons for increased activity in Patent Portfolio Trafficking, i.e. patent portfolios offered for sale or license. The second article described how companies with Small Volumes of portfolios to evaluate were able to streamline their patent evaluation processes from weeks to days using a Metric Driven Approach. This article looks at companies that have more fully integrated patent analytics into their patent portfolio acquisition process.

Prototypical Situation

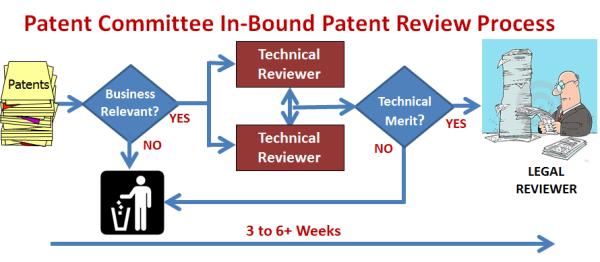

Having a larger number of portfolios to review the Medium Volume Case company has implemented a more robust but in many cases still somewhat rudimentary process for patent evaluation. This is likely to be a larger company – hence the increased volume of portfolios being reviewed – and is also likely to have in-house legal counsel, including patent counsel in many cases.

There is a more formalized process and patent evaluation responsibilities have been added to the job descriptions of some personnel – although typically this responsibility is not the sole or primary responsibility of the people involved. Often this company has a reasonable size patent portfolio of its own and a somewhat formalized process for reviewing invention disclosures from technical employees. In many cases the “outside patent portfolio evaluation” process has been “tacked” on to the duties of the Patent Committee, which is composed of technical and legal personnel and in some cases marketing or other business focused personnel.

Although the volume of patent portfolios being reviewed is larger (e.g., 10 to 20 per year), the actual process used before IPVision’s involvement is not dissimilar from the Ad Hoc Small Volume Case discussed in our second article.

The process suffers from many of the same issues:

Attributes of Medium Volume Patent Committee Review Process

- Some but Limited Business Context for Review

- Few, if any, Consistent Metrics Applied

- Limited Business Review or Visibility

- Time and Resource Consuming and Inefficient/ Costly and Slow

- Not Repeatable from one Patent Portfolio to another

- Not Scalable

The Patent Committee Process does have the benefit of creating some institutional and interdepartmental knowledge/memory but this comes at the cost of pulling people away from what they perceive as their primary jobs within the company to work on a time consuming and inefficient process.

IPVision Involvement

For the Medium Volume/Patent Committee Process company we can provide the same Claims Analytics and Patent Importance Ratings described in our second article. However, where a Patent Committee Process is already in place in a company we have found it to be more efficient and effective to start the patent acquisition due diligence at the portfolio level using IPVision’s Level 1 Portfolio Report.If the Level 1 Report shows that the patent portfolio as a whole is not highly rated then often no further work is required and the workload of the Patent Committee is reduced, saving time and effort of its members who do not have to be pulled away from their primary job responsibilities. If the Level 1 Rating is high then we proceed with further analyses of the patent portfolio and its individual patents.

Level 1 Patent Portfolio Report

IPVision’s Level 1 Report was initially designed for screening venture capital portfolio deals. Level 1 Portfolio Reports have been run on over 10,000 companies and portfolios. As described in our Intellectual Asset Management magazine article “IP in Early-Stage Commercial and Investment Success” there is a positive correlation between our Level 1 Ratings and Investment Success in venture capital portfolios – i.e., 86% of companies whose portfolios ranked in the top 25% of IPVision’s ratings were “Winners”, having been acquired or having had an initial public offering.

The Level 1 Report Rating of a patent portfolio is a weighing of three separate sets of analytic ratings.

The IP Portfolio Strength Rating is composed of vectors that define and measure these factors:

- Absolute and Relative Amount of Intellectual Property: The number of issued U.S. patents and published U.S. patent applications in the portfolio, normalized by technology area and time factors based on objective comparative data.

- Degree of Patent Portfolio Building. Through in-depth portfolio evaluations with and for clients over the past decade, it is clear that a portfolio in which patents cite other patents in the portfolio is indicative of strength as new patents build on existing intellectual property. Using this experience and extensive related calibration data, we developed measures for absolute and relative portfolio building measurement.

- Seminal Patent Analysis. Measures the degree to which there are highly cited patents in the portfolio.

The IP Landscape Rating is composed of vectors that define and measure the “crowdedness” of the intellectual property space around a patent portfolio. This assessment analyzes the patent citation landscape and uses extensive calibration data that is adjusted to take into account the technology area and age of the portfolio.

The IP Investment (Family Strategy) rating is composed of vectors that provide an initial measure of the sophistication of the patent prosecution strategy being pursued. The “size” of a Patent Family provides valuable information about the resources invested in the technology by its owner. A Patent Family includes applications in process (continuations, divisional applications, etc.) as well as issued patents that are related in their patent prosecution histories. An issued patent that is part of a large Patent Family is likely to be more important than one that (a) is not part of a Patent Family or (b) is part of a smaller Patent Family.

Use of the Level 1 Patent Portfolio Report

In our recommended process, if the Level 1 Report rating is “high” then the Patent Committee makes a second pass at assessing business relevancy of the portfolio. Depending on the maturity (sophistication) of the process and the industry setting the second pass business assessment might include a closer look at patents relative to the company’s products, revenue streams and gross margins and sometimes considering relationship to future product strategies. IPVision patent portfolio metrics frees up time for the Patent Committee to consider the business aspects of intellectual property in order to make more comprehensive decisions about patent portfolio acquisitions. We have found that consistent use of this approach has increased the business awareness of IP throughout a company.

Depending on how often the Patent Committee meets and other organizational specific preferences, we may also routinely run further patent due diligence analytics for portfolios with “high” Level 1 Ratings. These include the Claims Analysis and Patent Importance Ratings described in our second article as well as (1) a Patent Family Analysis to determine if the portfolio being offered includes the complete patent families of the patents and (2) a Chain of Title Report to identify any issues in the assignment history of the patent properties and to identify any security interests or licenses recorded in the USPTO Assignment Database. To complete the analytic package some companies also ask for a Patent Maintenance Fee Analysis (to see if the patents are still in force) as well as an Inventor Expansion Analysis (to determine if there are similar patents that may not be in the exact patent families presented).

Stage Gating

Some companies prefer to “stage gate” the process after receiving the Level 1 Report. They focus the Patent Committee’s time on strategic discussions about the top rated portfolios. Here the Patent Committee often engages other constituencies in the deliberations, usually including the appropriate strategic business units and in some organizations senior management input. If the decision from the stage gate process is favorable then the individual patent due diligence is run.

We have described a range of patent portfolio and individual patent evaluation analytics that IPVision uses to help companies design and implement more timely, cost-effective, evidence-based efficient patent portfolio evaluation processes. Some companies we have worked with used these to radically transform their current processes while other companies take a “module” approach to build out processes over time that best work in their culture and industry.

Next Time: Highly integrated, custom patent evaluation analytics being adopted by industry leading firms.

Author: Joseph G. Hadzima, Jr. | Senior Lecturer, MIT Sloan School of Management | Co-Founder & President of IPVision, Inc.